The specter of greenwashing looms large amidst a growing ESG rating market, casting a shadow over sustainability efforts for both companies and investors. A research project funded by the European Union revealed that more than half of the environmental claims made regarding products and services—53% to be exact—are either ambiguous, deceptive, or unfounded, with 40% of claims lacking evidence altogether.1. The proportion of greenwashing appears even more present in the United States, with 68% of corporate leaders acknowledging their involvement in greenwashing practices2.

These findings underscore the importance of vigilance in assessing companies' environmental claims for investors reliant on ESG ratings to guide their ethical investment decisions and companies assisted by ESG raters to improve their ESG disclosure.

In this post, we focus on the challenges ESG raters face when attempting to rate a company, given the prevalence of greenwashing. We will explore this practice and its associated risk, delving deeper into the challenges and opportunities faced by ESG raters in effectively incorporating greenwashing as a risk factor into their assessments.

What is greenwashing?

Greenwashing is not, as is sometimes believed, a situation in which a company has several public ESG-related commitments and management policies but nevertheless has poor ESG performance. Rather, it is a deliberate attempt to mislead the public and investors by issuing false or unverified environmental claims. And it is not taken lightly. Greenwashing is a legal term with real legal consequences for companies engaging in it. So, understanding the term is important to identify the right risks. The UK Law Society defines greenwashing as “untrue or misleading statements about the environmental performance or impact of a business, product or service.”3

There can be cases of unintentional greenwashing where companies unintentionally convey misleading environmental claims through a lack of understanding of environmental reporting or insufficient transparency. Such cases are observed with the use of vague expressions such as “net zero,” “environmental-friendly,” and “energy efficient,” making these claims subjective without direct evidence of intent to mislead. The legal repercussions are the same as those for intentional greenwashing and can be just as severe.

What are the associated risks?

Interest in ESG has surged globally, but the lack of clear standards has left the door open for misleading ESG statements. Regulators are catching up by implementing new laws intended to rein in misleading ESG disclosures to protect customers and investors. There is a global effort to address greenwashing:

In Europe,

- EU Green Claims Directive (currently in development)

- European Company Directive (EmpCo)

- Corporate Sustainability Reporting Directive (CSRD)

- the UK Sustainability Disclosure Requirements;

In the United States,

In Asia,

- Singapore’s green labeling scheme

- South Korea’s Environmental Technology and Industry Support Act

- Japan’s Green Claims Guidelines

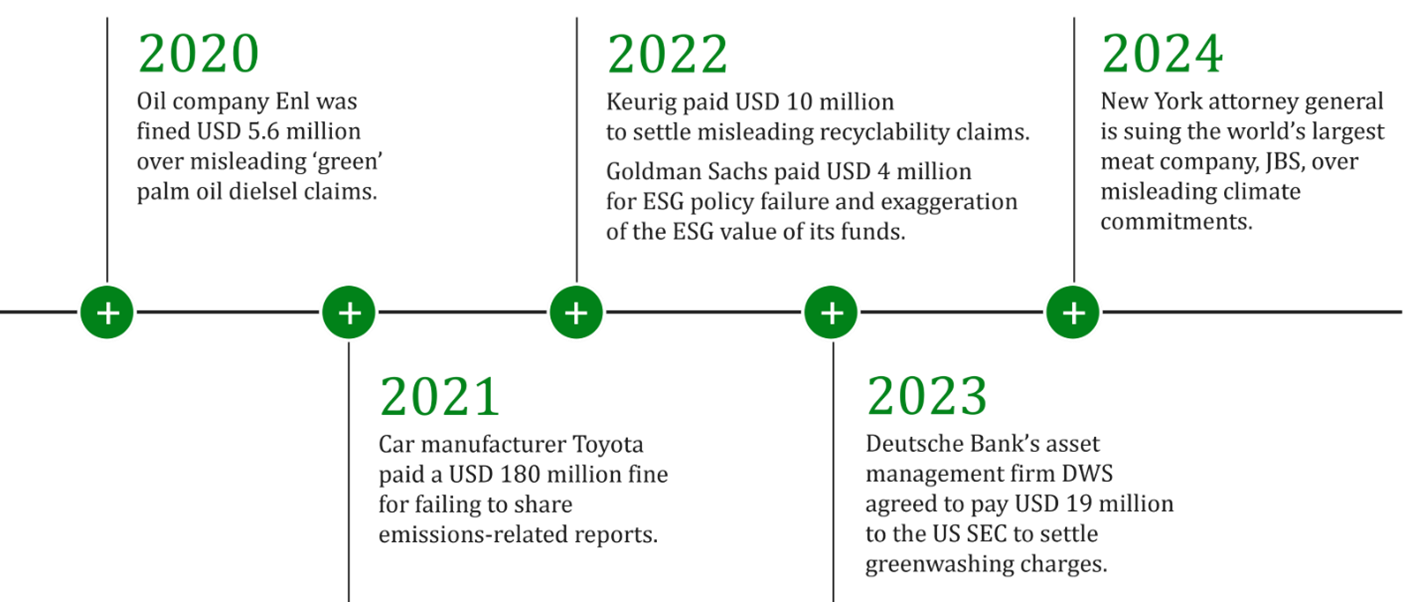

Greenwashing is a concern many companies and investors consider due to the legal, financial, and reputational risks. Therefore, it makes sense that ESG raters would assess it in their ratings as a risk exposure factor and a controversy. A prominent example of how greenwashing can hurt business is Volkswagen. In 2015, the company paid well over USD 20 billion in fines and legal settlements after it deliberately manipulated emissions data in diesel vehicles to falsely portray them as environmentally friendly, leading to significant air pollution and regulatory repercussions4. The figure below highlights instances from more recent years where companies faced legal action showcasing these risks.

Understanding the Stakes for ESG raters

So why is it important for ESG raters to understand the dangers of greenwashing and integrate related information into their ratings? Because their clients rely on ESG ratings to provide an accurate picture of companies' health, risks, and prospects. Having a clear-eyed view of greenwashing risks touches on three core aspects of what clients expect from ESG raters.

- Assessing Corporate Performance: ESG raters assess companies' ESG practices, aiming to prevent misleading stakeholders and investors by scrutinizing and evaluating claims for accuracy.

- Investment Decision-making: ESG raters offer reliable information to investors, aiding them in making informed decisions as they use ESG ratings to align their portfolios with sustainable and responsible companies.

- Promoting Accountability and Transparency: ESG raters drive corporate accountability and transparency, motivating companies to improve performance for investor trust, but unaddressed greenwashing jeopardizes rating credibility.

Recognizing the risk of greenwashing is essential for ESG raters to fulfill their role in promoting sustainability, guiding investment decisions, and holding companies accountable for their ESG performance.

Unmasking Greenwashing: Methods of Identification

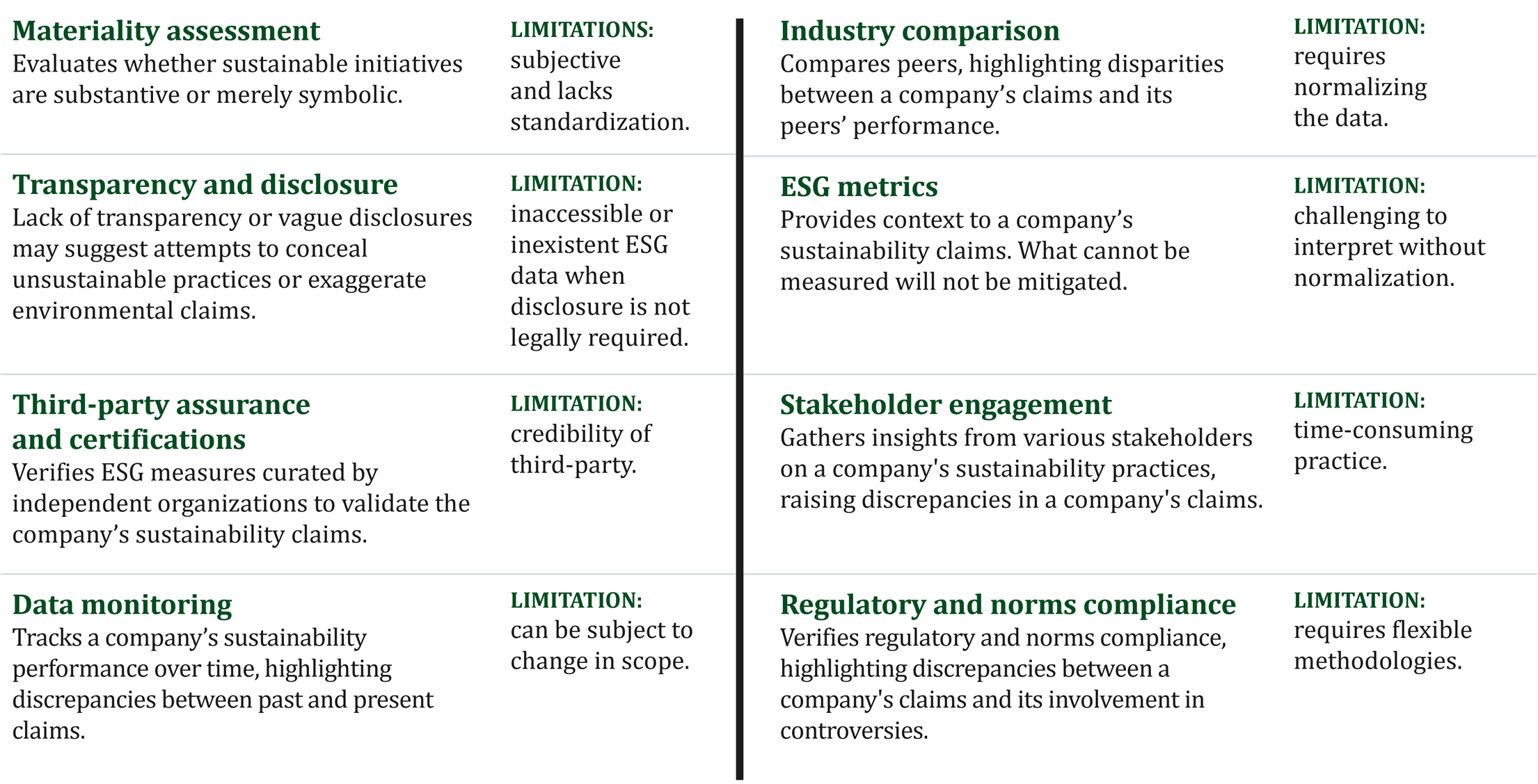

Of course, ESG raters don’t sit still. They apply several methods to identify potential greenwashing in their company assessments. Despite limitations, these methods represent current best practices in the field.

Navigating Greenwashing: Challenges for ESG Raters

ESG raters are not legal actors and have limited resources to prove intentional greenwashing. An ESG rater can only suggest the heightened risk of greenwashing for a company, given the evidence available to them in the assessment. Legal actions operate under a clearly defined regulatory framework, which includes investigations and legal processes. In contrast, risk assessments conducted by ESG raters aim to identify, evaluate, and mitigate potential risks. ESG ratings offer a real-time snapshot of a company’s situation, including on greenwashing, not a final judgment.

Unmasking Greenwashing: Opportunities from Technology

In the age of ChatGPT and NextGen AI, technologies open new ways to support ESG raters in their evaluation of companies’ ESG performance. Natural Language Processing (NLP) Technology, with its advanced text analysis capabilities, can assist in identifying and evaluating greenwashing practices5. From sentiment analysis detecting overly positive language to topic modeling uncovering inconsistencies in sustainability claims, NLP features prove to be the perfect assistant ESG raters’ experts need. However, like ESG experts, NLP will still face limitations of subjectivity, limited context, and lack of evidence. NLP can also be challenging due to the inherent limitations of text analysis. While artificial intelligence (AI) can help identify language patterns, inconsistencies, or anomalies suggestive of greenwashing, determining intent often requires a holistic and topic-level understanding of ESG risks. There is also a potential greenwashing danger in allowing AI to make critical decisions on ESG ratings; the human element is essential. ESG experts combined with the power of AI are identified as the best way to prevent greenwashing in ESG ratings.

Experts and AI: a powerful new team

In conclusion, the rise of greenwashing poses a growing risk for investors due to lower public tolerance and legal repercussions. Investors rely on ESG ratings to get a transparent picture of risks and opportunities, including greenwashing. Therefore, they must assess if the ESG raters they consult weigh those risks properly. Misleading representations of a company’s ESG performance threaten portfolios and investment strategies by increasing their exposure to regulatory, financial, and reputational risks.

Many ESG raters already deploy various methods to account for growing greenwashing risks. AI can be a powerful new tool to assist in delivering accurate greenwashing assessments. Leveraging AI offers ESG experts promising opportunities to help identify and mitigate greenwashing risks on behalf of their clients. Of course, AI has its own risks and limitations: the results it generates must always be investigated and used in combination with human expertise. However, when cautiously applied, AI has the potential to supercharge existing methods of identification and add several new ones.

1 Factsheet on European Green Claims (europa.eu)

2 68% of U.S. execs admit their companies are guilty of greenwashing - Fast Company

3 Greenwashing: what do you need to know? | The Law Society

4 EU Fines Volkswagen and BMW Nearly $1 Billion for Emissions Collusion - The New York Times (nytimes.com)