Companies have come a long way in getting their Scope 3, or value chain, emissions into focus, driven by regulatory and stakeholder pressure, new digital solutions, and supplier engagement. Now it’s time to take the next step and leverage Scope 3 data for value creation and business intelligence. This is the first article of a Sustainability Institute series on Scope 3 emissions disclosure and performance.

Emissions generated across company value chains have been emerging as a major issue on the corporate agenda. Indirect greenhouse gas (GHG) emissions (also called Scope 3), stemming from activities not owned or controlled by the company, often represent the largest share of company’s carbon footprint and are essential for achieving meaningful decarbonization results.

Scope 3, or value chain, greenhouse gas emissions data is becoming a new source of value creation and business intelligence for companies and their stakeholders, driven by emerging transparency requirements, digital solutions, product and service innovation, and supplier engagement. This is the first of two articles on Scope 3 emissions disclosure and performance. Please click here for the second article, ‘Three steps to leverage your Scope 3 disclosure for value creation’.

The growing focus on Scope 3 is also driven by emerging new regulations, including the EU Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD) and increasing financial pressures, such as rising carbon costs and investor and lender net zero alignment demands.

As companies accelerate efforts to reduce their carbon footprints, they are also realizing that Scope 3 data and initiatives can become a major source of value creation and business intelligence. Companies are looking for ways to maximize business value from their efforts to meet disclosure requirements, implementation of digital solutions, investments in product and service innovation, and supplier engagement initiatives.

There is growing evidence linking decarbonization with tangible positive commercial outcomes. For instance, ERM’s work supporting clients with IPOs, decarbonization business plans, lender due diligence, and private equity deals indicates that companies with a robust net zero roadmap and science-aligned targets tend to have higher market valuations and lower financing costs as they can capitalize on and manage risks more effectively.

In order to meaningfully capitalize on opportunities presented by decarbonization, companies’ climate strategies must reach beyond operational emissions (Scopes 1 and 2) to include the full upstream and downstream value chain (Scope 3). Increasingly, businesses are also expected to consider emissions avoided when a company’s low-carbon products are used as a substitute for other goods or services.

Understanding where Scope 3 can add business value

A robust baseline assessment and decarbonization plan for Scope 3 can deliver many benefits. The following are some of the areas that companies should consider as they map out their value chain emissions initiatives:

- Differentiated products and services. that both retail and business customers are choosing certain products and services that are low carbon in manufacture and use. Understanding where the emissions are in the supply chain can enable more extensive carbon reductions. Conversely, without robust data on value chain emissions and a strong narrative, companies run the risk of being accused on “greenwashing”.

- Increased customer loyalty. Focus on climate change and GHG reductions can have a positive impact on customer loyalty, particularly for public-facing brands, but increasingly for B2B companies as well. Customers are actively seeking more accurate data about what they buy in order to reduce their own emissions footprint by making more informed purchasing decisions.

- Enhanced operational efficiency. More accurate and comprehensive emissions data can help to increase operational efficiency and reduce costs throughout the supply chain. For example, in the transportation of products and materials, such solutions might include optimizing shipping routes, shipping in bulk and packaging near the final point of sale, centralized distribution centers, product substitution, etc. Energy savings also offer cost and carbon reduction opportunities and allow suppliers to mitigate the effects of future energy price or carbon tax increases.

- Identifying investments and innovations. As the demand for lower carbon solutions grows, there is significant opportunity for investment and innovation. Companies can leverage emissions data to develop new products, services, and business models that are more sustainable and can lead to market differentiation and increased revenue streams. Technologies such as wind-powered transportation, light weight packaging, and hydrogen are experiencing increasing investments and integration into business models.

- Supporting a net zero strategy. Demonstrating lower GHG emissions and a commitment to achieving further reductions can also create opportunities to access more favorable investment and financing options. The vast majority of the lifecycle emissions of a product are typically from raw material production, transportation, and product end use. By identifying these key contributors, investments and actions can focus on the parts of the value chain that will realize the biggest return. Suppliers across value chains are also looking for ways to reduce their emissions, so by working with those suppliers and customers, companies can also have a multiplier effect on making progress towards emission reduction goals.

Increasing engagement of C-Suite and other leaders

To achieve effective management of value chain emissions, it should be integrated into the larger business strategy. The C-suite and other leaders are increasingly playing a central role in this process, including determining governance and KPIs, approving decarbonization investments, overseeing audit and sign off for disclosures, defining the level of ambition for GHG targets and linking them to executive remuneration.

The complexity of disclosure for the 15 different Scope 3 categories across the value chain also requires input from teams in finance, procurement, sustainability, digital, HR, and other business leaders with responsibility for sustainability performance, supply chain, products and services, customers and partnerships. Many companies will need to introduce new management processes, invest in climate tech solutions, and develop new resources and capabilities to tackle the Scope 3 challenge and maximize business value.

Insufficient understanding or integration of Scope 3 insights into strategic decision making, including setting goals, developing low-carbon products/services, marketing strategies, or making investment decisions, leaves value creation potential untapped. Key carbon risks in the supply chain could also be missed or underestimated.

Scope 3 emissions reporting and management is in many ways more complex than for Scopes 1 and 2 (as detailed in Figure 1), due to challenges including poor data from suppliers, large and complex supply chains, and uncertainty in emission factors, for example from biogenic (emissions from natural sources) and FLAG (forestry, land use and agriculture) emissions.

Figure 1: Comparison of sectoral Scope 3 emissions hotspots with data quality Hide

Source: ERM Insights, MSCI Scope 3 Carbon Emissions, SBTI Value Chain Report

Developing a Scope 3 strategy: Seven core steps

Below we outline the key steps to develop a robust Scope 3 value creation strategy, underpinned by digital solutions:

- Conduct an initial hotspot analysis to identify which Scope 3 categories are likely to be material (i.e., highest source of emissions) and determine biggest data gaps (e.g. using a screening tool or by comparison with CDP, SBTi or available peer data). AI-enabled value chain emissions mapping is opening up new possibilities for companies to gain a competitive advantage in value chain decarbonization.

- Once the hotspot analysis has been completed and your company has a comprehensive view of Scope 3 data, with the help of interpretation and analysis, opportunities for value creation can be identified and robustly quantified. This often requires a multi-functional team. More granular data can unlock more value levers.

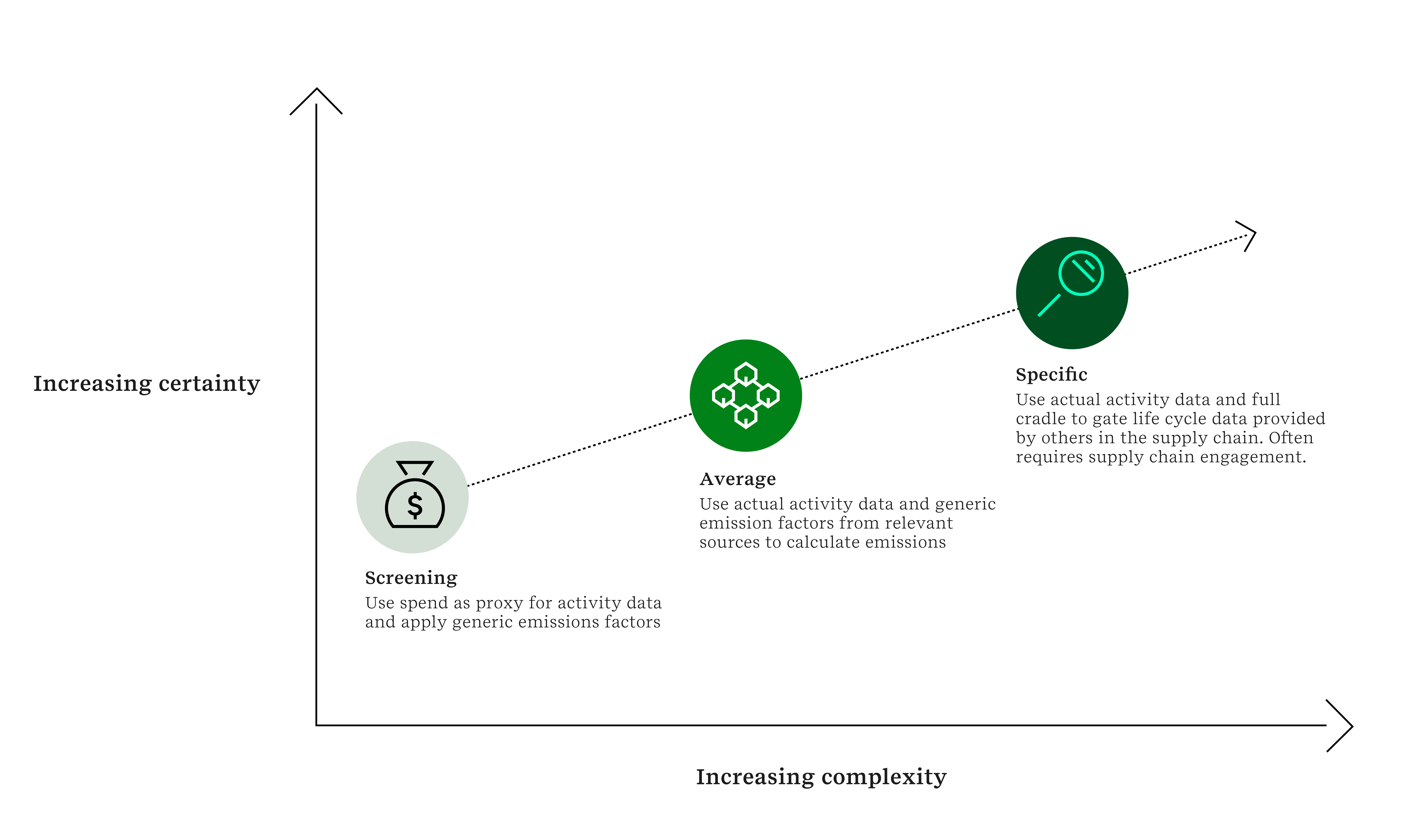

- Insights are only as good as the data they are built upon, so driving for more complete and higher quality data (as detailed in figure 2) will allow more realistic and more nuanced insights and business decisions. Using an assurance perspective can help increase this data quality, with a focus on materiality and reducing uncertainty over time.

Figure 2: Developing and maturing a Scope 3 inventory involves using a range of approaches Hide

- Use GHG data to inform target setting that is science-aligned, and define stakeholder engagement actions.

- Track progress against relevant business and emissions KPIs at least quarterly (e.g. % estimated data, % suppliers science-aligned, tCO2e GHG savings), factoring in external targets and disclosure needs. Use of climate tech platforms to gather activity data, supplier data and emission factors can greatly simplify and standardize the process of quantifying and tracking progress to reduce emissions from a number of different sources.

- Gather activity data for each reporting year covering Scope 3 hotspots across the value chain, from purchased goods and services, and capital goods through to business travel, employee commuting, product end-use, waste, and pension investments. Prepare for limited assurance for minimum 95% Scope 3 emissions in line with GHG Protocol guidance.

- Engage directly with suppliers to understand their incentives and disincentives for improving reporting and performance. Working collaboratively with the most material suppliers can have a noticeable impact on the quality of Scope 3 data, setting you up for success in decarbonization and unlocking business value.

Approaching Scope 3 emissions reporting and performance as a value creation exercise, companies stand to gain many opportunities. They will achieve better alignment with customers, reduce carbon costs, enhance operational efficiency, increase exit multiples, and make progress towards corporate net zero goals that will strengthen their position in the evolving marketplace focused on sustainability.